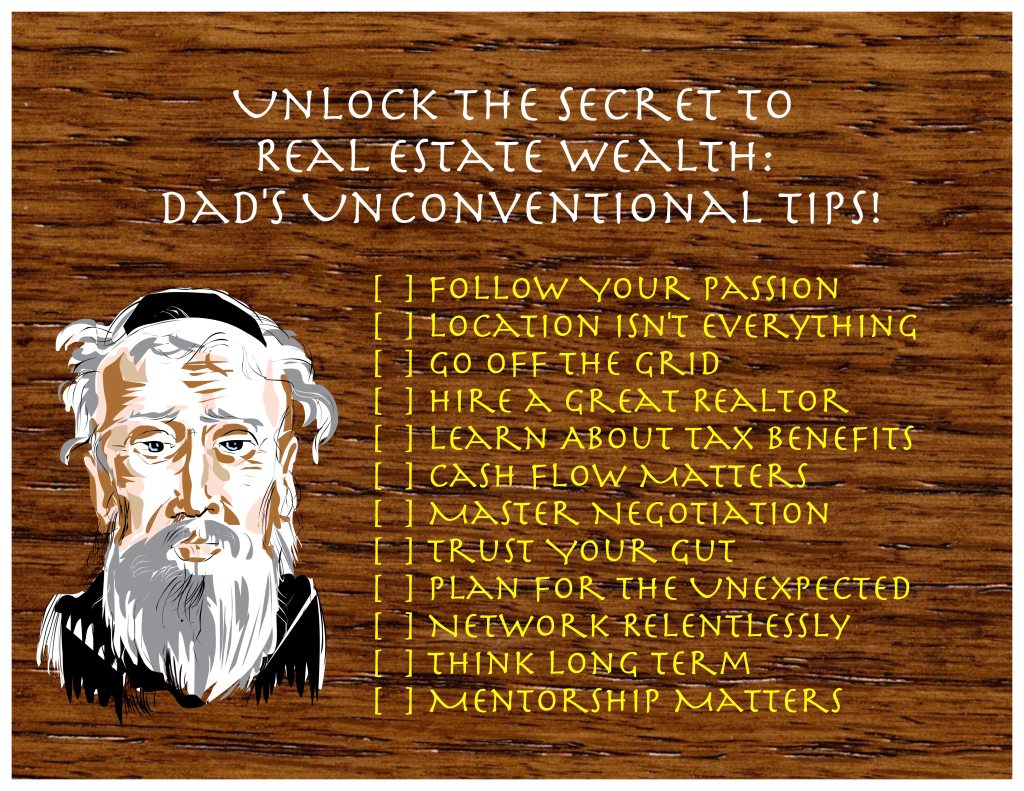

Real estate investment isn’t just about bricks and mortar; it’s about securing your financial future. As a 80-year-old dad who’s seen the highs and lows of the real estate market, I want to share some unconventional yet invaluable tips with my 25-year-old daughter and anyone else looking to make smart real estate investments. These tips might not be the ones you hear every day, but they come from years of experience in the industry and are designed to help you make well-informed decisions that will set you on the path to success.

- Follow Your Passion

First and foremost, follow your heart. Invest in something that you’re passionate about. It could be an old historic home that you’d love to restore, a sprawling farm where you can escape the city, or a quirky commercial property that excites your entrepreneurial spirit. When you’re passionate about your investment, you’re more likely to put in the effort required for success.

- Location Isn’t Everything

While location is vital in real estate, it’s not the only factor to consider. Don’t be afraid to look beyond the glamorous neighborhoods. Up-and-coming areas often offer fantastic investment opportunities. You can buy properties at a lower cost, add value through improvements, and benefit from the area’s growth.

- Go Off the Grid

Conventional real estate investments typically involve houses or apartments. But if you’re looking for something different, consider offbeat property types. Warehouses, tiny homes, houseboats – there’s a world of possibilities out there. Just be sure to research the market and demand for these unique properties.

- Hire a Great Realtor

Your realtor can be your biggest asset. Find an agent who knows the local market inside out. They can guide you on market trends, negotiate on your behalf, and connect you with valuable resources. A great realtor is worth their weight in gold.

- Learn About Tax Benefits

Real estate offers unique tax advantages. Learn how to maximize these deductions and incentives. Deductions for mortgage interest, property taxes, and depreciation can significantly reduce your taxable income. Consult a tax professional to understand how to leverage these benefits effectively.

- Cash Flow Matters

Always buy properties with the intent of making money from day one. Speculating on future values is a risky game. Ensure that your rental income covers all expenses, including mortgage, property taxes, insurance, maintenance, and property management costs. Positive cash flow is a reliable sign of a healthy investment.

- Master Negotiation

Negotiation skills are crucial in real estate. Never accept the first offer. Haggling over the price, terms, or included fixtures and appliances can mean the difference between an average deal and a fantastic one. Be confident, do your research, and don’t be afraid to walk away if the deal doesn’t meet your criteria.

- Trust Your Gut

Numbers and market data are important, but sometimes, it’s the intangible aspects of a property that matter most. If something doesn’t feel right about a potential investment, even if all the statistics check out, trust your instincts. Real estate is a long-term commitment, and you want to be comfortable with your choice.

- Plan for the Unexpected

Real estate investments come with ongoing expenses, and surprises can pop up when you least expect them. Budget for maintenance, repairs, and other unforeseen costs. Having a financial cushion for these situations will keep your investment stress-free.

- Network Relentlessly

Connect with other real estate investors. Attend local real estate meetings, join online forums, and engage with people who share your passion. Networking exposes you to valuable insights and experiences from others who have been in the game for a while. Learning from their successes and mistakes can be incredibly beneficial.

- Think Long Term

Real estate is a long-term game. When considering an investment, think about how it will look in a decade or more. The most successful real estate investors are patient and take a big-picture view. It’s about building wealth steadily over time, not chasing quick wins.

- Mentorship Matters

Finding a mentor who’s been in your shoes and achieved success is a priceless resource. They can provide guidance, share their experiences, and help you navigate the complex world of real estate investing. Seek out a mentor who resonates with your goals and values.

As my daughter embarks on her own real estate journey, I share these unconventional tips as a testament to the fact that real estate is a diverse and exciting field. Remember, each property is a canvas for your financial future, and the choices you make today will shape your wealth for years to come.

So, be passionate, think outside the box, and don’t be afraid to forge your own path. Real estate is about more than just properties; it’s about creating your own legacy. Trust yourself, stay diligent, and I’ll be right here, cheering you on every step of the way.

Happy investing!

by: Jonas Montemayor, Real Estate Broker, PRC Registration Number: 0007396, +639399222710, invest@JonasMontemayor.com

Leave a comment